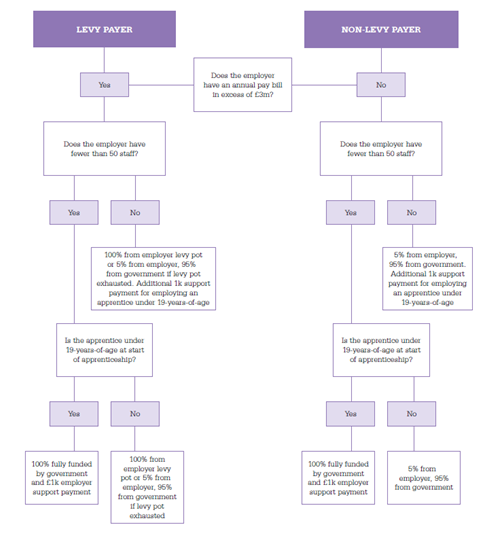

If your company’s UK paybill is above £3million per year it will pay 0.5% of its payroll into the apprenticeship levy on a monthly basis, and so will be a levy payer. Employers who aren’t connected to another company or charity will have an apprenticeship levy allowance of £15,000 each year. The allowance reduces the amount of apprenticeship levy you have to pay by £15,000 across the year.

These funds can then be used to pay for apprenticeship training via the digital account.

It’s worth knowing: each month’s funds expire after 24 months. For example, May 2017 funds expired in May 2019. The Government tops up the levy payer’s pot up by 10% for the English paybill only.